Flooz.com Concept

For every good dot-com idea, there are a handful of really terrible ideas. Flooz.com was a perfect example of a “what the heck were they thinking?” business. Pushed by Jumping Jack Flash star and perennial Hollywood Squares center square.

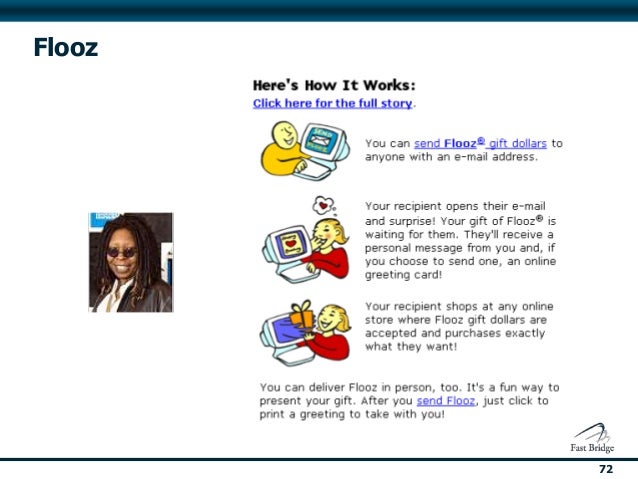

Whoopi Goldberg

Flooz was meant to be online currency that would serve as an alternative to credit cards. After buying a certain amount of Flooz, you could then use it at a number of retail partners. While the concept is similar to a merchant’s gift card, at least gift cards are tangible items that are backed by the merchant and not a third party.

It boggles the mind why anyone would rather use an “online currency” than an actual credit card, but that didn’t stop Flooz from raising a staggering $35 million from investors and signing up retail giants such as Tower Records, Barnes & Noble, and Restoration Hardware.

How Flooz Works:

Flooz.com Some Advertisement

In a statement posted to its Web site, Flooz admitted that attempts to save itself by finding a buyer had failed. "Flooz.com has been adversely affected by dramatic changes in capital markets and the general slowdown in the economy. Flooz.com had been in merger discussions with a number of companies but was unable to find a suitable partner," it said.

Flooz.com's collapse comes hot on the heels of the closure of fellow online currency company Beenz.com. Both firms, during the heady days of the Internet boom, had hoped to dominate the new economy landscape, but it seems that credit card payment will prevail on the Internet, in the short term at least. However, Levitan said yesterday that he thought that Flooz had been a great idea, and predicted that another company would make a success of Internet gift vouchers in the future.

Flooz. com Case

Failures

- From praise to criticism

- Security problems,

- There’s tons of buzz around the idea

- Flooz.com until it held enough in reserve to cover possible fraudulent orders.

- This caused Flooz.com's cash flow to break down, as it was under obligation to pay Internet retailers who were still accepting flooz as payment for online purchases.

- In 1999, digital currency was like a gift card without a store to back it’s value.

- In the end, the overall consumer reaction was “why?”